Korea’s Exports Surpass $700 Billion

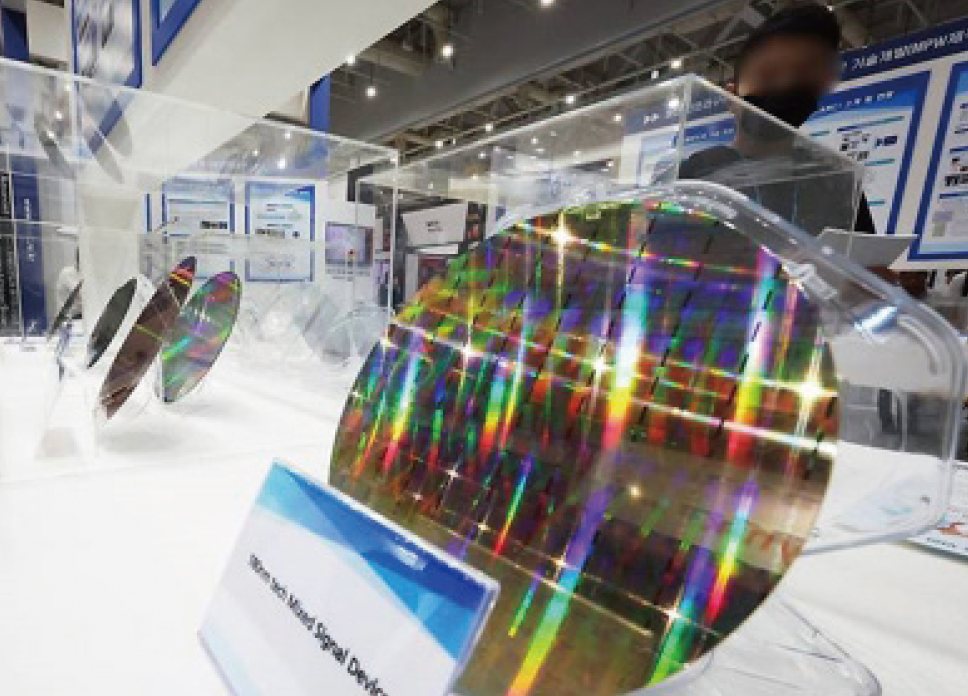

Last year, Korea’s exports surpassed $700 billion for the first time, achieving a record high. Fueled by the artificial intelligence (AI) boom, semiconductor exports reached a record high of $173.4 bil., driving the overall export growth. Exports in December last year increased by 13.4%, the highest-ever in December.

According to the Ministry of Trade, Industry and Energy (MOTIE), last year’s exports reached $709.7 bil., a 3.8% increase from the previous year, surpassing the previous record set in 2024. Daily average exports also rose by 4.6% to $2.64 bil., reaching a record high.

Semiconductor exports, the nation’s largest export item, surged by 22.2% to $173.4 bil., driven by rising prices and the booming investments in AI and data centers. This marked another record high, following the previous year’s record.

Automobile exports also reached a record high, rising by 1.7% to $72 bil. While exports to the United States, the largest market, declined due to the impact of U.S. tariffs, exports to the European Union (EU) and the Commonwealth of Independent States (CIS) saw positive growth, driven by robust exports of eco-friendly and used vehicles.

Bio and health exports increased by 7.9% to $16.3 bil., continuing their positive trend for the second consecutive year. Exports of ships (up 24.9% to $32 bil.), computers (up 4.5% to $13.8 bil.), and wireless communication devices (up 0.4% to $17.3 bil.) also showed strong performance. With the growing popularity of K-food and beauty products, exports of agricultural, fishery, and food products ($12.4 bil.), cosmetics ($11.4 bil.), and electrical instruments ($16.7 bil.) have surged to record highs.

On the other hand, exports of petroleum products decreased (down 9.6% to $ 45.5 bil.) due to falling oil prices, while exports of petrochemicals (down 11.4% to $42.5 bil.) and steel (down 9.0% to $30.3 bil.) decreased due to global oversupply.

1.7% to $130.8 bil. Exports to the USA fell by 3.8% to $122.9 bil. While exports of most items, including automobiles, general machinery, and auto parts, declined due to the effects of U.S. tariffs, the double-digit growth in semiconductor exports mitigated the decline.

Last year, the trade surplus with the United States was $49.5 bil., down by $6.1 bil. from the previous year. Exports to ASEAN increased by 7.4% to $122.5 bil., and exports to the EU increased 3.0% to $70.1 bil. Exports to the CIS also grew by 18.6% to $13.7 bil.

Last year, Korea’s imports decreased by 0.02% year-on-year to $631.7 bil. Non-energy imports, such as semiconductor manufacturing equipment, increased, but energy imports decreased due to factors such as falling oil prices. Korea’s trade balance last year recorded a $78 bil. surplus.

Exports also hit a record monthly high in December, reaching $69.57 bil., a 13.4% increase. Korea’s monthly exports have continued to increase year-on-year for the 11th consecutive month since turning upward in February.

Semiconductor exports increased 43.2% year-on-year to $20.77 bil., marking the 10th consecutive month of growth and a record high. However, automobile exports decreased by 1.5% to $5.95 bil. due to the effects of U.S. tariffs and increased overseas production of Korean automobiles.

Exports to China increased 10.1% to $13 bil., marking the second consecutive month of positive growth. Exports to the United States rose by 3.8% to $12.3 bil., breaking the record for December and returning to growth after five months.

korean-machinery.com | Blog Magazine of korean-machinery, brands and Goods