Petrochemical companies undergo restructuring, including selling core assets.

Japan underwent restructuring in the 2000s.

Korean petrochemical companies’ profitability continues to worsen.

The petrochemical industry in structural stagnation faces credit rating risks spreading across the industry, depending on the direction of business restructuring.

The petrochemical industry, suffering from both decreased profitability and financial burdens due to the prolonged recession, is thus undergoing large-scale, government-led restructuring.

Major petrochemical companies recently signed contracts for business restructuring and agreed to present specific plans by the end of the year, aiming to achieve the reduction of up to 3.7 million tons of NCCs proposed by the government.

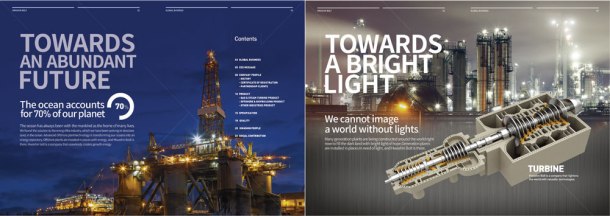

In Korea’s three major petrochemical industrial complexes — Yeosu, Daesan, and Ulsan — discussions are underway on vertical integration with refineries, and horizontal integration between adjacent NCCs.

Compared to Japanese petrochemical companies, which underwent industrial restructuring earlier, Korea’s profitability is unfortunately deteriorating.

In 2023 alone, Korea’s petrochemical companies’ operating profit margin reached 2.5%, surpassing the 1.8% margins of eight Japanese petrochemical companies, including Eneos and Mitsubishi Chemical. However, last year Japan surpassed Korea with an operating profit margin of 3.7%.

korean-machinery.com | Blog Magazine of korean-machinery, brands and Goods